Empower Every Contractor To Get Paid On Time

Activate dependable payout experiences with automated compliance, instant confirmations, and transparent fee controls.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

Under 30 Minute Settlement

Automated release flows trigger payouts the moment a milestone is approved.

Compliance-Ready Everywhere

KYC, AML, and tax reporting handled across 135+ jurisdictions with zero extra lift.

120+ Currency Options

Route funds to mobile wallets, banks, and cards in each receiver's preferred currency.

Flexible Receiving Channels Built In

Talent choose mobile wallets, bank accounts, or multi-currency balances while your finance team monitors every step.

Instant Mobile Wallets

Deliver payouts to M-Pesa, MoMo, Wave, and more without managing extra vendors.

Local Bank Accounts

Route funds to beneficiaries with IBAN, ACH, and localized routing coverage built in.

Multi-Currency Wallets

Let talent hold, convert, or withdraw balances across 120+ currencies on demand.

Keep Every Dollar You've Earned

Receivers preview fees, FX, and arrival times before approving a payout, protecting both their income and your brand.

Upfront Transparency

Display guaranteed fees and real-time FX rates before a payout is submitted.

Receiver Control

Allow talent to pick the channel, confirm details, and download receipts instantly.

Arrival Speed Alerts

Predict delivery windows and notify payees the moment funds settle.

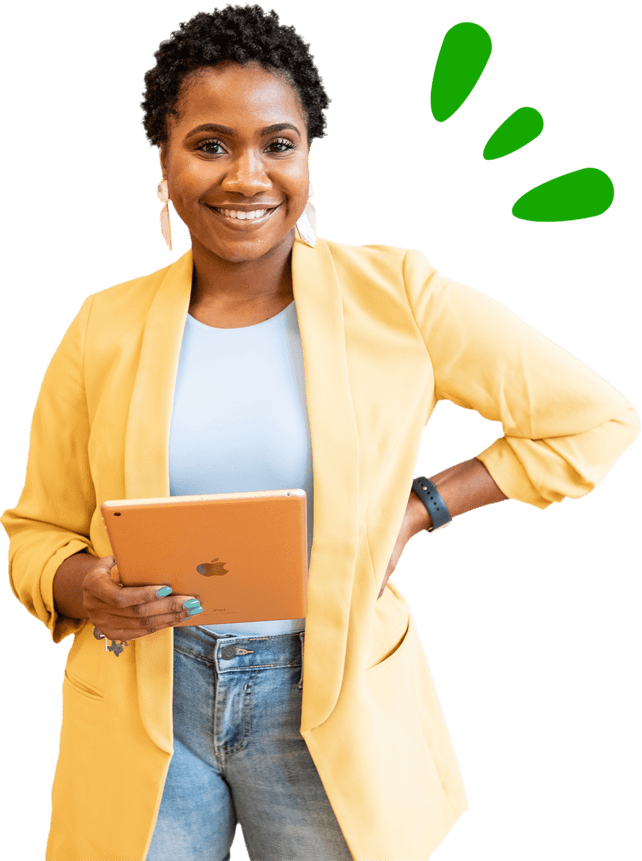

How Talent Gets Paid With Confidence

A guided receiving flow keeps payouts secure from invoice to withdrawal, even across jurisdictions.

Invoice & Submit

Talent upload deliverables, generate invoices, and trigger Odepay's secure receivables workflow.

Compliance Verified

Automated KYC, AML, and tax checks run behind the scenes before funds leave escrow.

Withdraw Anywhere

Receivers choose their preferred channel and cash out instantly once approvals clear.

Your Payouts Protected From End To End

Escrow releases, compliance monitoring, and localized partners keep every receiving journey safe and auditable.

Escrow-backed assurance protects both payer and receiver on every milestone release.

Enterprise-grade encryption and audit trails satisfy SOC 2 Type II requirements.

Locally licensed partners ensure compliance across 100+ banking jurisdictions.

Coverage Snapshot

135+

Countries with regulated payout coverage

350+

Banking, mobile money, and card endpoints